Tin tức

ASEAN – GLOBAL TRADE OPERATION

Executive summary

In the context of globalization and the rising cooperation in Southeast Asia, from a humble starting point, ASEAN has made positive contributions in promoting cooperation, connectivity not only in Southeast Asia but also in the East Asia and Pacific regions. Looking at the multilateral cooperation network in the region, it is easy to see that the word “ASEAN” appears quite often, with the participation of many different partners, including many large countries such as the US, China, Russia, EU, India,… Although the effectiveness of these cooperation frameworks still receives different assessments, it cannot be denied that the forums initiated by ASEAN have continued to expand, still attracting revenue. attracts large and regular participation from countries, especially large countries. This paper aims to provide a perspective on the history of formation, import/export statistics, trade instruments, and difficulties that ASEAN faces in coming from These solutions are for reference only but also contribute to the goal of building ASEAN into a complete and effective organization.

1. Introduction

ASEAN (Association of South East Asia Nations) was established to strengthen economic, cultural, and social cooperation among members, and to adapt to the trend of globalization. ASEAN has a population of 656 million people with an area of 4,500,000 square kilometers. ASEAN includes 10 members: Vietnam, Laos, Cambodia, Brunei, Indonesia, Malaysia, Myanmar, Philippines, Singapore, and Thailand (Tuoi Tre 2022). Furthermore, ASEAN is also characterized by religious diversity and practices including Buddhism, Christianity and Animism, Islam, and Hinduism (University of Sydney n.d). After more than 55 years of formation and development, ASEAN has made positive changes in the nature and content of cooperation to become a successful regional cooperation organization, playing an important role in peace, stability, and cooperation. cooperation and development in Southeast Asia and around the world. The development goal in the new phase of the Association is to build a Community based on 3 pillars: politics-security, economics, and socio-culture. The famous Motto of ASEAN is “One Vision, One Identity, One Community” (ASEAN Main Portal 2022).

2. Background

2.1 Brief trade history

ASEAN was established on 8 August 1967, in Bangkok, Thailand when the foreign ministers of five countries – Indonesia, Malaysia, Philippines, Singapore, and Thailand – met at the Thai foreign ministry building and signed the ASEAN declaration. Five foreign ministers, Adam Malik (Indonesia), Narciso Ramos (Philippines), Abdul Razak (Malaysia), S. Rajaratnam (Singapore) and Thanat Khoman (Thailand) are considered the founding fathers of the organization (Rappler 2017 )

-In 1992, along with the post-Cold War world trend of focusing on economic development and trade, ASEAN signed a framework for a mutually effective tariff preferential program for the ASEAN free trade area ( CEPT/AFTA), beginning the process of regional economic liberalization. Also this year, ASEAN issued a declaration on the East Sea establishing the principle of resolving conflicts in this region by peaceful means.

-27 February 2009 The 14th ASEAN Summit took place, a free trade agreement between the 10 ASEAN member countries and New Zealand and their close partner Australia was signed, it is estimated that the agreement was signed. This free trade agreement will increase the GDP of 12 countries by more than 48 billion dollars in the period 2000-2020. (ASEAN Main Portal 2022).

2.2 Trade Statistics of ASEAN

According to Euro stat 2019, the partners to which ASEAN exports the most goods include ASEAN countries (23%), China (14%), United States (13%), EU (9%), Japan (8%), Hong Kong (6%) and others (26%).

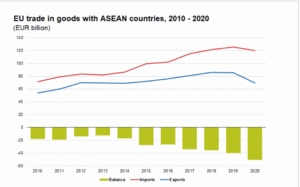

Figure 1: EU trade in goods with ASEAN countries 2010-2020

From 2010 to 2020, trade between ASEAN and the EU grew impressively, however, there has been a decline in trade between the two countries due to COVID-19. In 2010 the EU exported 54 billion EUR to ASEAN countries and in 2019 it was 85 billion EUR.

In term of import, the EU imported goods from ASEAN worth 72 billion EUR in 2010 and 125 billion EUR in 2019.

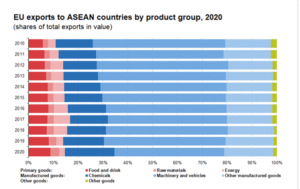

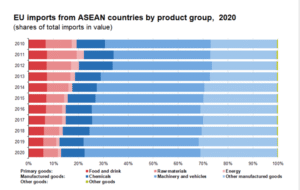

EU exports and imports to ASEAN main products such as Food and drink, raw materials, energy, chemicals, machinery and vehicles, and other manufactured goods. Notably, there is a decrease in machinery and vehicles from 53% (2010) to 44% (2020), chemical is an increase in chemical goods from 15% (2010) to 20% (2020).

Figure 2: EU exports to ASEAN countries by product group (Euro stat 2019)

Figure 3: EU imports to ASEAN countries by product group (Euro stat 2019)

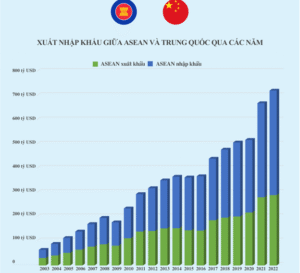

China officially surpassed the US and EU to become ASEAN’s largest trading partner. According to data from the General Administration of Customs of China, in the first 7 months of 2023, ASEAN continues to be China’s largest trading partner. If calculated in USD, the total trade value between China and ASEAN is 519.0 billion USD, down 3.8%. Of which, exports reached 304.85 billion USD, down 2.0%; Imports reached 214.14 billion USD, down 6.3%. (Vietnamplus n.d)

Figure 4: ASEAN import (blue) and export (green) to China

3. Trade instruments

3.1 Trade policy and procedure

Tariffs are an integral part of the price of exported or imported goods. To encourage exports and imports, the government applies low tariffs, conversely to limit exports and imports, the government applies high tariffs (Cadot et al. 2015). Quota is a regulation that limits the maximum number of items or value of items allowed to be exported or imported through the market in a certain period, usually within 1 year without a license (Wattanapruttipaisan 2005).

ASEAN is an important market for the EU in increasing imports and exports, so eliminating tariffs makes an important contribution to the circulation of goods in the region. Participating countries will have to aim for a final free goods ratio, of at least 90% and possibly up to 95% (possibly with some flexibility for less developed countries. In the EU context, There are FTAs with Singapore and Vietnam but the EU does not have bilateral agreements with other members in ASEAN, so the freedom of goods will eventually face many obstacles.

FTA ASEAN+1, it can be seen that 3 ASEAN countries have committed to eliminating tariffs on average from 90%, including Brunei, Malaysia, and Singapore, while the remaining 7 countries have a higher tariff rate of 90%. Liberalization is lower than 90%, of which Vietnam has an average goods freedom rate of 86.5%. The average partner goods freedom rate for ASEAN countries is 91%, while ASEAN’s goods freedom rate for partners is 88.3% (Mai 2018)

3.2 Critical review- barriers and challenges of the implementation

The market entry of businesses with investment capital from countries around the world will create competitive pressure on businesses in ASEAN in terms of capital scale, experience, product diversity, and product quality. Products.

According to Tap Chi Cong San 2023, the challenges facing ASEAN include (I) the quality of export products is relatively low, difficult to compete and does not meet standards for export to the EU region, ( II) Labor costs of ASEAN countries have been considered an advantage for a long time, but this advantage is not guaranteed because average wages tend to increase in the future, (III) Production costs of ASEAN is not stable because it is not proactive in sourcing raw materials for production and must depend on imported raw materials. (IV) The level of technology used is at an average level even though it has been invested and upgraded. Some industry groups that will face big challenges when participating in EUAFTA include plastics, electronics, textile fibers and textile materials, machinery and equipment, agriculture, automobiles-motorcycles,…

3.3 Recommendations

ASEAN needs to develop a negotiation plan to ensure proactive steps appropriate to each time, negotiate developments, balance its interests among other member countries, prepare resources, and conduct consultations. ministries, local. Develop a plan focusing on import tax commitments in signed FTAs according to the roadmap, review, propose modifications, and carefully evaluate trade relationships with partners, especially foreign partners. cooperate with main trade relations, research and evaluate the impact of implementing tax reduction commitments on budget revenue, production, and business on important industries (Ly Luan Chinh Tri 2023).

National competitiveness needs to be promoted, strengthening the production and export capacity of businesses in the ASEAN block, encouraging the development of key industries, and improving product quality.

Promote propaganda information, disseminate commitments in the agreement to relevant subjects, and organize seminars and policy dialogues to share information to help businesses understand the provisions of the agreement as well as Commitment to tariff reduction, regional value content regulations through procedures for issuing certificates of origin.

4. Conclusion

Non-traditional security challenges from environmental pollution, climate change, transnational crime to economic challenges, or the Covid-19 pandemic continue to threaten ASEAN’s development. However, after more than a decade of development, ASEAN has proven to the world that it is a stable and prosperous trade zone, contributing to the development of member countries, enhancing regional security, narrowing the development gap, and building a strong economy. A closely linked, united united ASEAN will play an increasingly important role not only in the region but also in the world.

5. References

ASEAN Main Portals 2022, About ASEAN, accessed 20 March 2024, https://asean.org/about-us/.

Cadot, O., Munadi, E., & Yan Ing, L. (2015). Streamlining Non-Tariff Measures in ASEAN: The Way Forward. Asian Economic Papers, 14(1), 35–70. https://doi.org/10.1162/ASEP_a_00315

Euro Stat 2019, ASEAN-EU – international trade in goods statistics, accessed 25 March 2024, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=ASEAN-EU_-_international_trade_in_goods_statistics&oldid=526930#ASEAN_countries_trade_in_goods_with_main_partners

Ly Luan Chinh Tri 2023, Một số giải pháp nhằm phát huy vai trò của Việt Nam trong các cơ chế đa phương do ASEAN dẫn dắt, accessed 22 March 2024, http://lyluanchinhtri.vn/home/index.php/quoc-te/item/5076-mot-so-giai-phap-nham-phat-huy-vai-tro-cua-viet-nam-trong-cac-co-che-da-phuong-do-asean-dan-dat.html

Mai MTL 2018, Đánh giá tác động thương mại giữa ASEAN và EU, Mof.gov.vn. https://mof.gov.vn/webcenter/portal/ttncdtbh/pages_r/l/chi-tiet-tin?dDocName=MOFUCM187189

RAPPLER 2017 Who were ASEAN’s 5 founding fathers?, accessed 20 March 2024, https://www.rappler.com/newsbreak/iq/177220-asean-founding-fathers/.

Tap Chi Cong San 2023, Vai trò trung tâm của ASEAN, thách thức, triển vọng và hàm ý, accessed 20 March 2024,

The University of Sydney n.d, 5 things you didn’t know about ASEAN, accessed 20 March 2024, https://www.sydney.edu.au/sydney-southeast-asia-centre/news/5-facts-about-asean.html.

Tuoi Tre 2022, 45 năm ASEAN – EU: Tương đồng nhiều hơn khác biệt, accessed 21 March 2024, https://tuoitre.vn/45-nam-asean-eu-tuong-dong-nhieu-hon-khac-biet-20221214075221122.htm

Vietnamplus 2023, Kim ngạch thương mại Trung Quốc-ASEAN đã tăng từ 100 tỷ USD năm 2004 lên 975,34 tỷ USD năm 2022, accessed 24 March 2024

Wattanapruttipaisan, T. (2005). Quota-free Trade in Textiles and Clothing: Policy Issues and Options for ASEAN. Asian Development Review, 22(1), 71–96. https://doi.org/10.1142/S0116110505500046